Jurupa Valley Bankruptcy Attorney

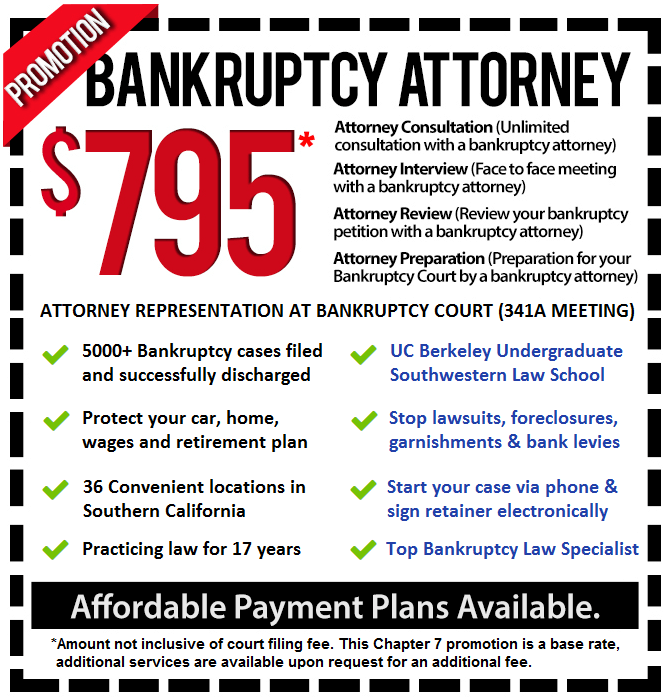

Whenever the economy takes a downturn or a major employer leaves a community, bankruptcy filings increase. In other cases, a sudden catastrophic illness or injury may strike and a family is unable to meet its debt obligations. For many of these individuals and businesses, they can turn to a Jurupa Valley bankruptcy attorney at (844) 643-7109.

A Jurupa Valley bankruptcy attorney handles the 3 major types of bankruptcy. A straight or Chapter 7 bankruptcy allows consumers and businesses to be rid of most debt. If a Jurupa Valley bankruptcy attorney verifies a consumer’s eligibility to file, then the personal assets are examined to see if they are exempt or not.

Jurupa Valley Businesses may dissolve their assets under Chapter 7 to pay off creditors without further obligations. If a debtor is ineligible to file or a Jurupa Valley bankruptcy attorney advises against it, a Chapter 13 is available where the debtor’s creditors are repaid. A business can file under Chapter 11 to reorganize while repaying creditors over time.

Contact a Jurupa Valley bankruptcy attorney to discuss whether bankruptcy can be a solution to your debt issues.

Chapter 7 Bankruptcy

If you are considering Chapter 7 and are a Jurupa Valley consumer, a Chapter 7 Bankruptcy Lawyer will confirm your eligibility based on your income. If eligible, the Chapter 7 Bankruptcy Lawyer will also review your assets for exempt status. If safe and you elect to file, your Chapter 7 Bankruptcy Lawyer will prepare a petition of your finances and transactions over the past 2 years. This is reviewed by the trustee at a meeting in which you and your Chapter 7 Bankruptcy Lawyer will attend.

If all is in order, you can expect a discharge in the next 60 to 90 days of your unsecured debt such as credit card charges, department store bills, medical bills, unpaid utility and rent, repossession deficiencies, some unpaid taxes, personal loans and promissory notes. Your Jurupa Valley bankruptcy lawyer will explain what debts are non-dischargeable.

Chapter 13 Bankruptcy

If your income is too high or too many of your assets not exempt, a Chapter 13 Bankruptcy Attorney may advise that you elect the wage earner’s plan. This bankruptcy is a repayment proceeding where a Chapter 13 Bankruptcy Attorney submits a plan for you to repay creditors over 3 or 5 years in a single monthly payment to a trustee for distribution. Only individuals and sole proprietors can file. There is a debt limit that a Chapter 13 Bankruptcy Attorney will review to see if you exceed it.

Chapter 13 can hold off foreclosures and repossessions and have the arrearages included in the plan. A Chapter 13 Bankruptcy Attorney can also devalue debt to its market value for the plan and save you money.

Business debt can be included if the Jurupa Valley sole proprietor personally guaranteed it.

Chapter 11 Bankruptcy

If your Jurupa Valley business has stifling debt interfering with its operations, have a Jurupa Valley bankruptcy lawyer advise you on the feasibility of a Chapter 11. When filed, a Chapter 11 Bankruptcy Lawyer submits a disclosure statement for creditors to review so they can make an informed decision about the reorganization plan, also filed by the Chapter 11 Bankruptcy Lawyer.

Certain creditors who would not have their debt repaid in full vote to confirm or reject the plan. If confirmed, the company debtor resumes its daily business operations. However, its restructuring plans will have to be court approved if any materially affect the Juruapa Vally business such as downsizing, selling off assets, hiring particular specialists, and re-negotiating existing agreements.

The company’s Jurupa Valley bankruptcy lawyer files progress reports with the court and deals with creditor issues until the business emerges as a solvent entity or is sold, merged with another company or converts to a Chapter 7.

Call a Jurupa Valley bankruptcy lawyer at (844) 643-7109 for additional information about how bankruptcy can be a solution to debt problems.

(844) 643-7109